jersey city property tax rates

View this luxury home located at 40 Baruch Drive Long Branch New Jersey United States The continued efforts of our city to stimulate. Online Inquiry Payment.

Tax Collector S Office City Of Englewood Nj

243k members in the jerseycity community.

. Ad Search County Records in Your State to Find the Property Tax on Any Address. The Tax Collectors office is open. Fulop introduced today the 620 million CY 2021 municipal budget which will cut taxes for.

11 rows City of Jersey City. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. 2 seconds ago 18moreshowsthe pit magnet theater and more Donâ t let the high property taxes scare you away from buying a home in New Jersey.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. The tax rate is set and certified by the Hudson County Board of Taxation. Jersey City New Jersey 07302.

Table of Equalized Valuations. Mayor Steve Fulop hailed the news on Twitter. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. A community for redditors in and around Jersey City New Jersey. Equalized tax rate in Loch Arbour Village Monmouth County was 1102 in 2017.

Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. The Jersey City Council has unanimously passed. The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change.

On average the states property taxes rose 1 percent from 8953 to 9112 between. The latest sales tax rate for Jersey City NJ. Photo by Mark Koosau.

The average effective property tax rate in New Jersey is 242 compared to. There is no applicable county tax city tax or special tax. 2020 rates included for use while preparing your income tax.

We had placed a call to the property tax administrator who had provided the. Enter an Address to Receive a Complete Property Report with Tax Assessments More. The 6625 sales tax rate in Jersey City consists of 6625 New Jersey state sales tax.

The minimum combined 2022 sales tax rate for Jersey City New Jersey is. This rate includes any state county city and local sales taxes. 2 days agoMay 31 2022.

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. You can print a 6625 sales tax table here. In fact rates in some areas are more than double the national average.

New Jersey Tax Court on January 31 2022 for use in. 189 of home value. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents. Heres our list of the 30 town with the lowest tax rates. Homeowners in New Jersey pay the highest property taxes of any state in the country.

The New Jersey sales tax rate is currently. The approved resolution states that the tax bills must be prepared and mailed by August 1. City of Jersey City.

JavaScript chart by amCharts 32114. County Equalization Tables. 587 rows All Current 2021 Property Tax Rates and Average Tax Bills for New Jersey Counties and Towns on a Map.

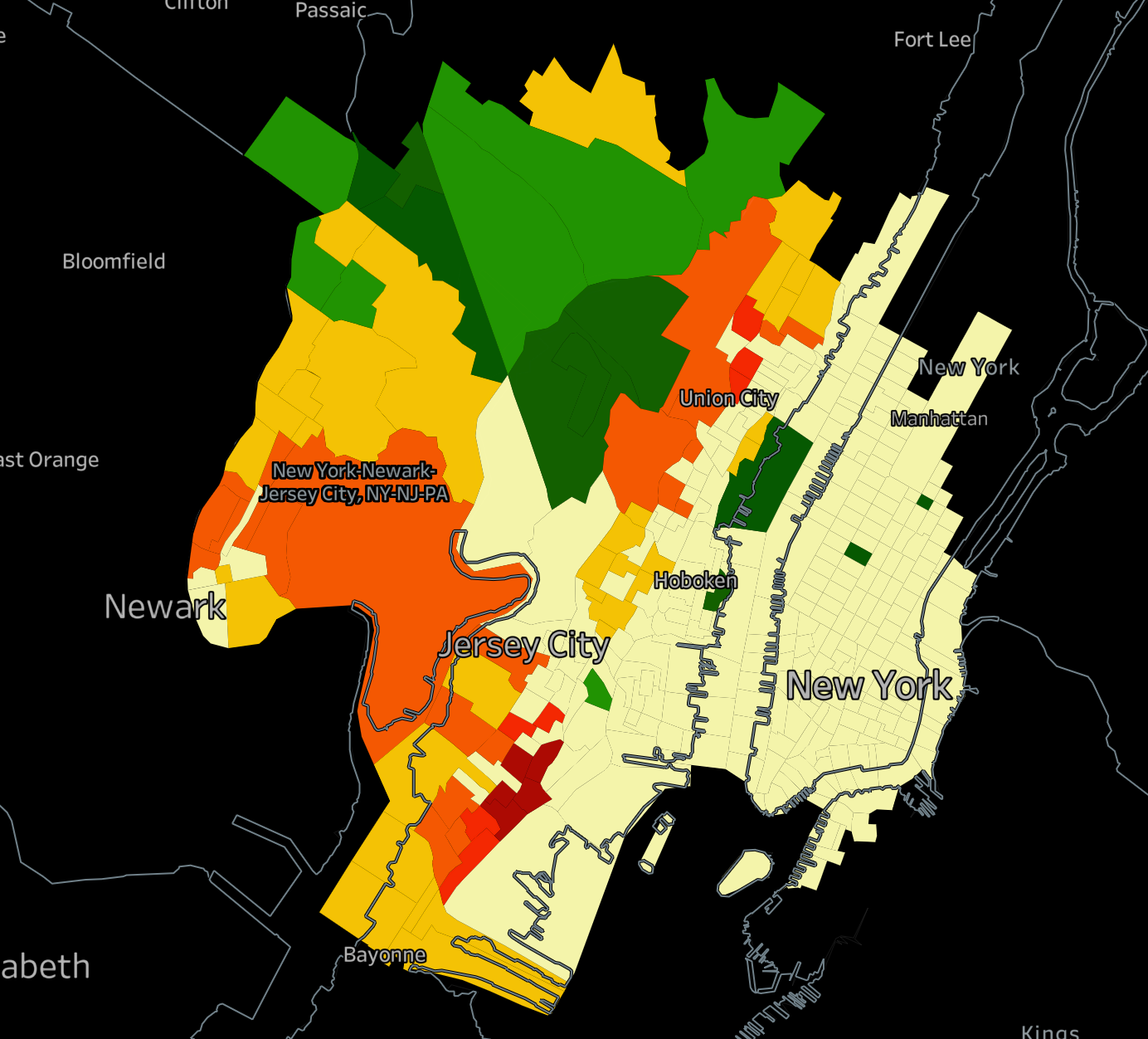

Jersey City Property Tax Rate. This is the total of state county and city sales tax rates. The Tax Collectors office is open 830 am.

Property Tax Rates Average Residential Tax Bill for Each New Jersey Town. 27 votes 39 comments. 10 25 50 75 100 All.

Jersey City establishes tax levies all within the states statutory rules. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 1 252 31 252 51 252 227 252 5677 252. Each business day By Mail - Check or money order to.

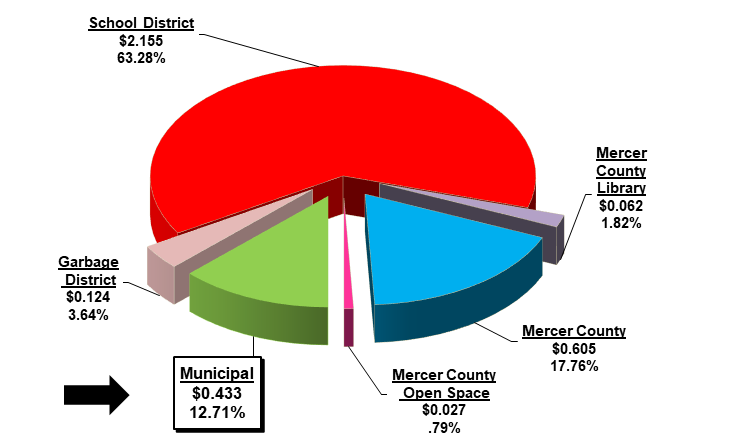

In Jersey City the average residential school tax in 2021 was. 27 votes 39 comments. The data released this month comes from the state Department of Community Affairs.

Certified October 1 2021 for use in Tax Year 2022 As amended by the. Overview of New Jersey Taxes. Tax amount varies by county.

PROPERTY TAX DUE DATES.

States With The Highest And Lowest Property Taxes Property Tax States Tax

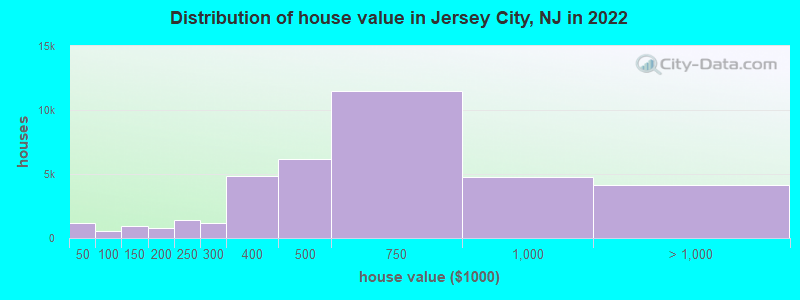

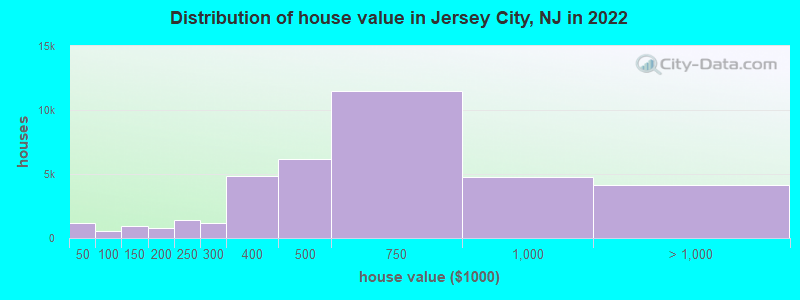

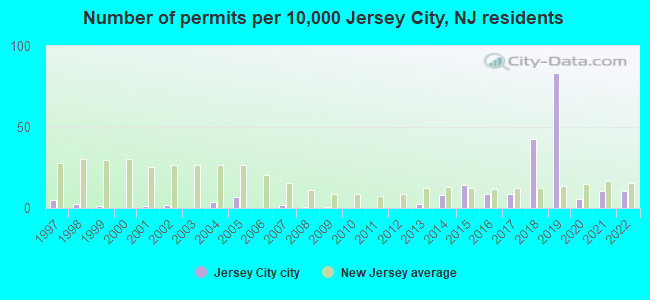

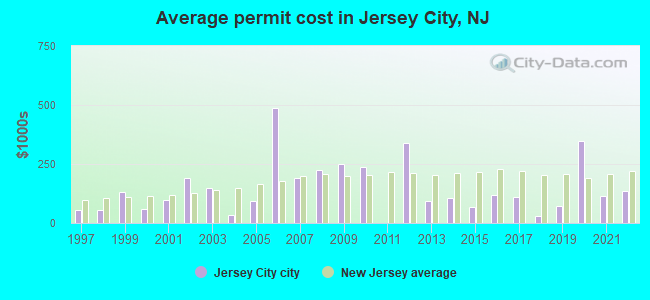

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Official Website Of East Windsor Township New Jersey Tax Collector

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

These Towns Have The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

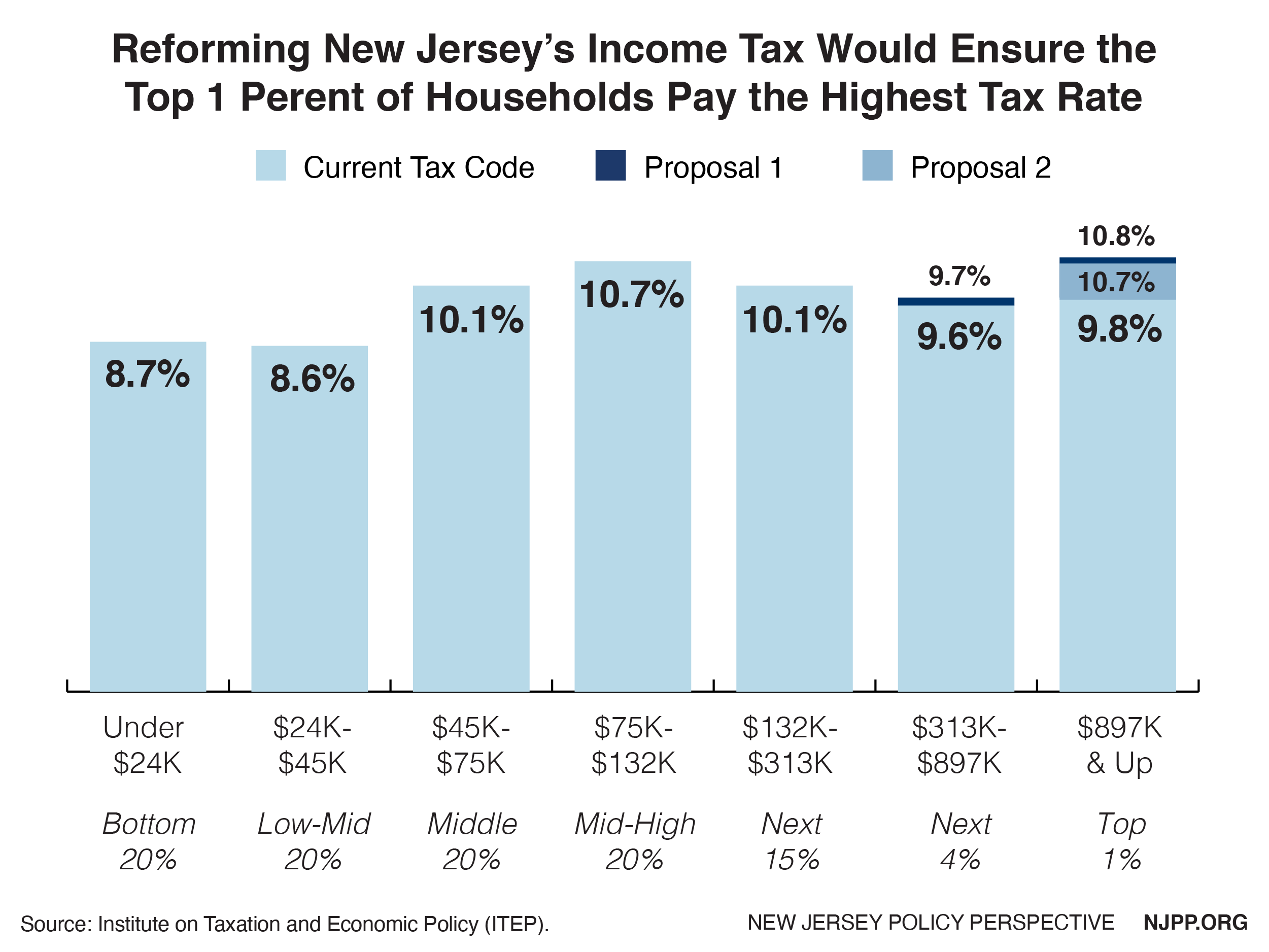

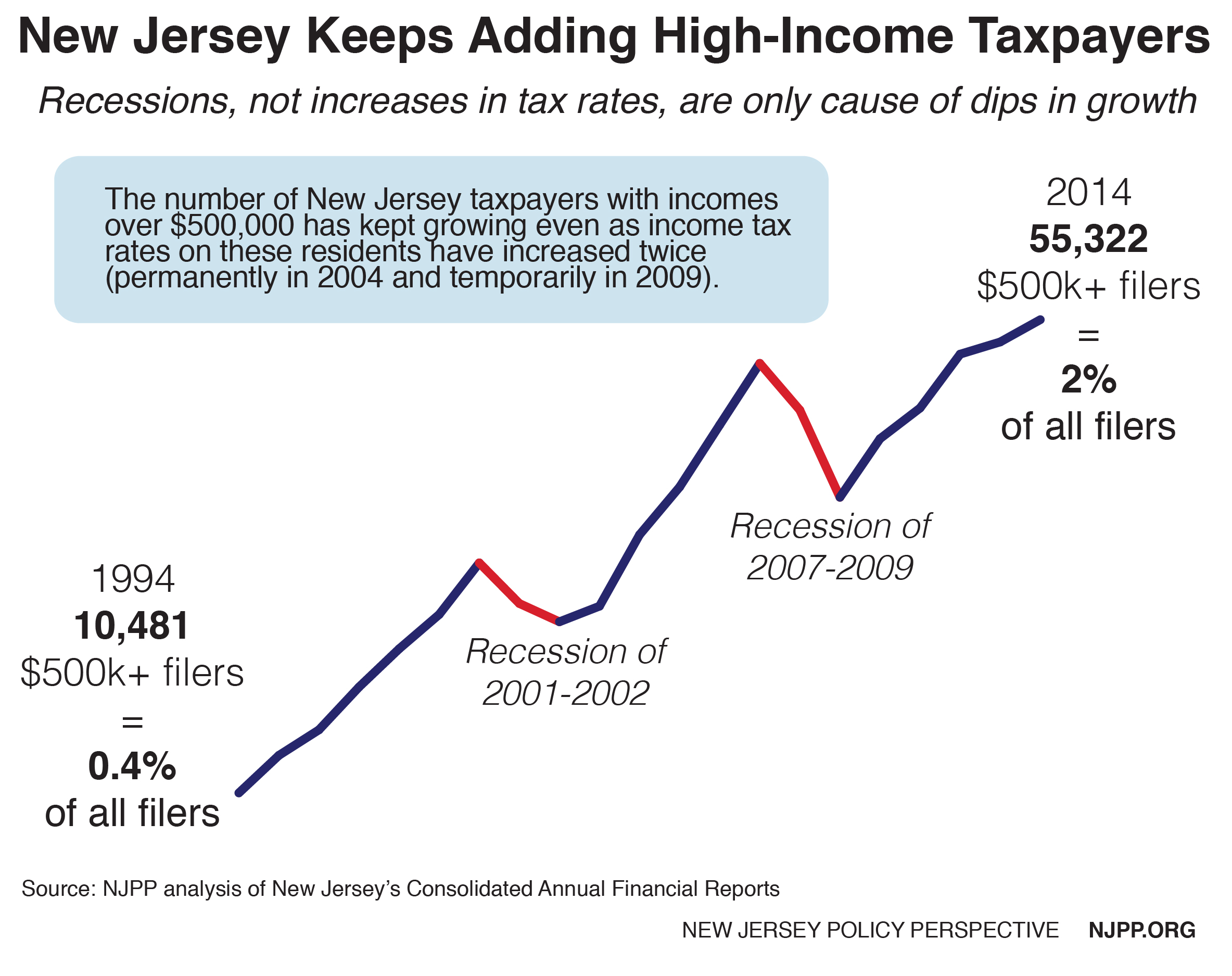

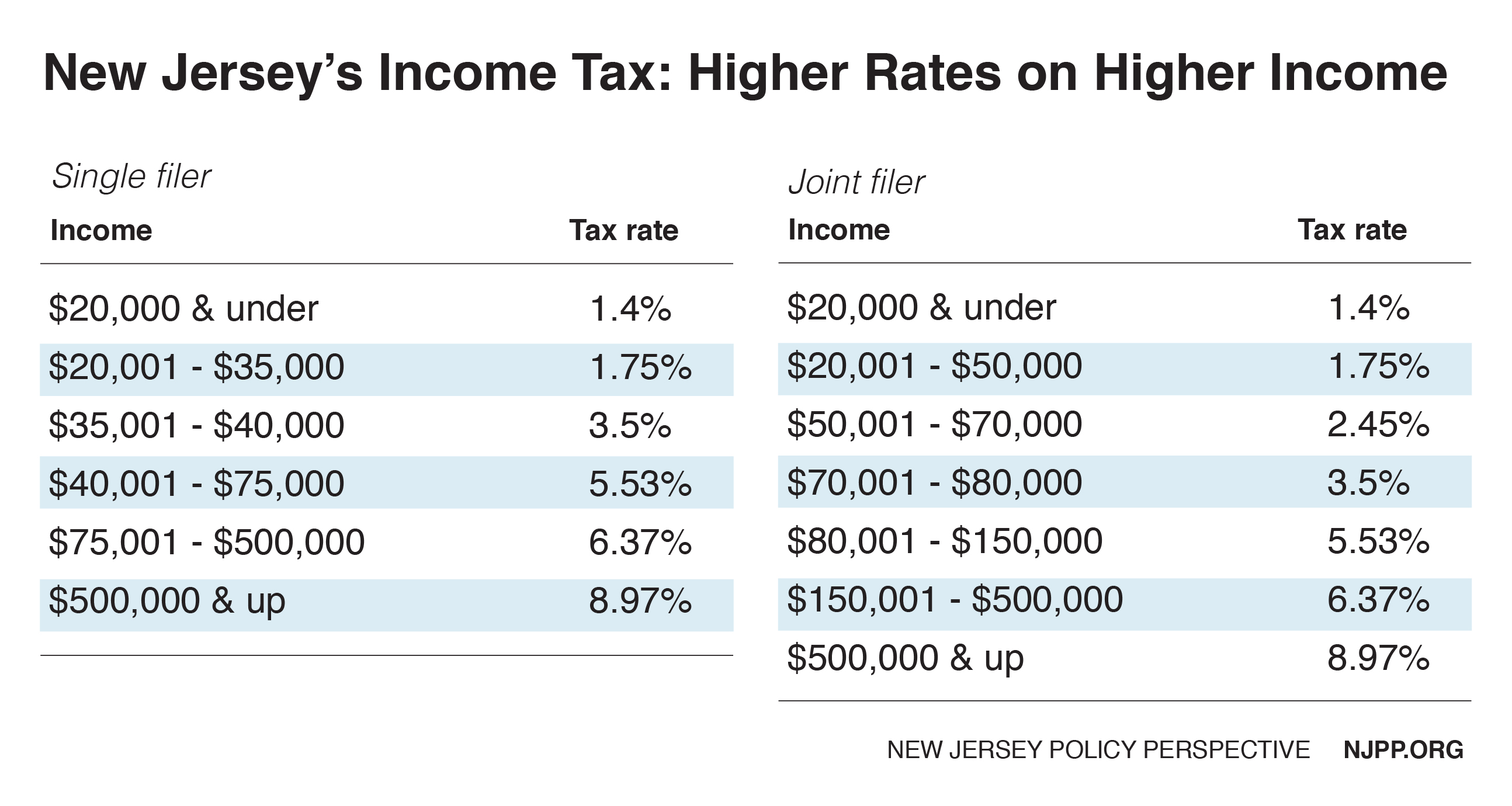

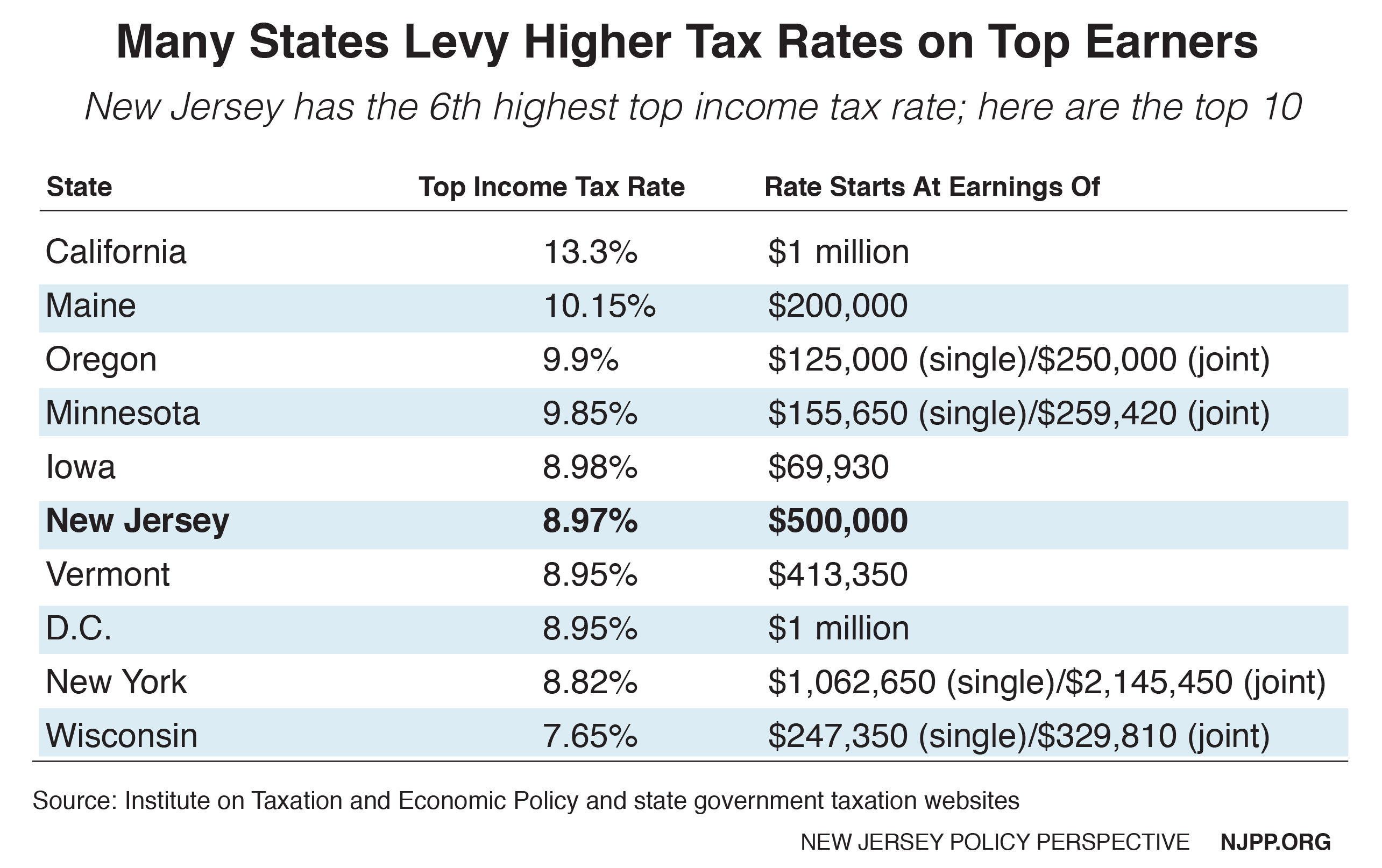

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Real Estate Market Prices Trends Forecasts 2022

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Real Estate Market Prices Trends Forecasts 2022

The Jersey City Real Estate Market Stats Trends For 2022